Gone are the days when cash and credit cards were required to pay for services or loan friends a couple of dollars. Now, you can send funds back and forth on your phone using Cash App. It's a platform that allows you to send, save and even invest your money.

Cash App is a convenient service that's free and easy to use. Since being launched in 2013 by Square Inc., Business Insider reports the app has accumulated more than 24 million monthly active users. Haven't used Cash App before? No problem. We'll walk you through everything a beginner needs to know about Cash App.

Advertisement

How Is Cash App Different From Banking?

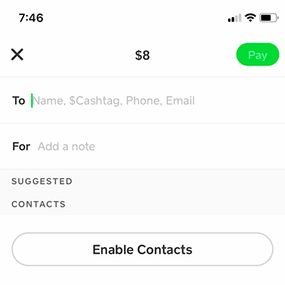

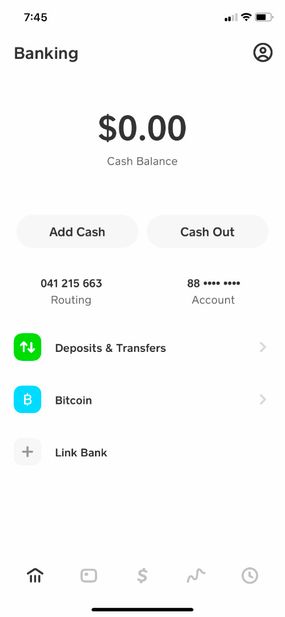

Cash App is a peer-to-peer payment service that allows you to send, receive and request money. The money will appear in your Cash App account as credit. Another option is linking your account to an existing bank card and using it to transfer money to and from your Cash App account. Cash App is similar to other free money transferring apps like Venmo, Zelle, Dwolla and PayPal.

Companies pay Cash App particular fees so customers can use their phones to pay for goods and services. It's essentially a digital wallet that eliminates the need for cash or traditional credit cards. Although you're only able to spend $250 within a seven-day period and receive up to $1,000 within a 30-day period, your limits can be increased by verifying your identity.

Similar to other money services, Cash App will charge you a 3 percent fee for sending money via credit card. You will also be charged a 1.5 percent fee when opting for instant transfers from the app to your bank account. Luckily, this charge is avoidable by waiting two to three days through a standard transfer process.

All information that's submitted to Cash App is securely encrypted to servers, so it's safe for you to use on private or public internet connections. The app also can detect if fraudulent activity is happening to your account. Users can add extra safety to their account by enabling a security lock in order to make payments.

Cash App takes its financial services one step further and allows users to purchase cryptocurrency and trade stocks commission-free. You can invest as little as $1 into stocks and easily convert your dollars to Bitcoin with a few taps in the app. Additionally, you can track the BTC price, stock prices and monitor your overall investment portfolio in real time through the app.

Advertisement